Ambrose Evans-Pritchard

THE EU AND ITALY ARE AT WAR – LET’S HOPE ITALY WINS

Do not assume that Italy’s insurgent coalition will capitulate to EU demands if risk spreads on Italian debt blow through the fatal line of 400 basis points.

The European Commission’s strategy of ‘controlled escalation’ relies on tacit collusion with bond vigilantes and hedge funds to ratchet up the pressure. The method is to squeeze the capital buffers of Italian banks and ultimately to set off a deposit run, hoping that such financial vandalism does not set off contagion to Portugal, Spain, and Greece.

This is a dangerous game to play unless you can be sure that the Lega-Five Star alliance will back down rather than resort to radical measures in self-defence. The obvious risk is that Italy’s budget fight with Brussels will cause a pan-European financial crisis before either side blinks.

“Brussels can keep sending its silly letters until Christmas. Our budget is not going to change. The gentlemen speculators will just have to get used to it, because we will not retreat,” says Lega strongman, Matteo Salvini, relishing a political knife-fight with the EU all the way to the European elections next May.

It’s a fight we should want Salvini to win.

THE EU’S COUP AGAINST DEMOCRACY IN ITALY

Italy’s pro-euro elites have overreached disastrously. President Sergio Mattarella has asserted the extraordinary precedent that no political movement or constellation of parties can ever take power if they challenge the orthodoxy of monetary union.

Italy’s pro-euro elites have overreached disastrously. President Sergio Mattarella has asserted the extraordinary precedent that no political movement or constellation of parties can ever take power if they challenge the orthodoxy of monetary union.

He has inadvertently framed events as a battle between the Italian people and an eternal ‘casta’ with foreign loyalties, playing straight into the hands of the insurgent Five Star ‘Grillini’ and anti-euro Lega nationalists. He unwisely invoked the specter of financial markets to justify his veto of euroskepticism.

Taken together, his actions have made matters infinitely worse. First the background, then what’s happening right now. Italy has had 65 governments since WWII, so political chaos is almost the norm – but this is bizarre even by Italian standards.

Yet this crisis has been wholly manufactured by Berlin, Brussels, and the EU power structure. They may have made a mortal blunder.

IS GERMANY HEADED FOR RECESSION?

The economic outlook in Germany is deteriorating with alarming speed and any mistake by policy-makers could push the country into a full-blown slump, a leading economic institute has warned.

The economic outlook in Germany is deteriorating with alarming speed and any mistake by policy-makers could push the country into a full-blown slump, a leading economic institute has warned.

“The danger of recession has increased markedly. It is a notably more critical picture than a month ago,” says the Macroeconomic Policy Institute (IMK) in Düsseldorf.

The IMK’s early warning indicator says the recession risk over the next three months has jumped suddenly to 32.4% as trade tensions mount and liquidity ebbs away in the international financial system.

Germany is heavily reliant on world trade and is therefore a bellwether for the broader health of the global economy. Its industrial sector lurched abruptly from boom to bust early in the last downturn and proved to be a leading indicator for the Great Recession.

WILL ITALY KILL THE EURO, KILL ITSELF, OR BOTH?

Italy has progressed from pre-insurrectional anger to outright revolt. Insouciant markets are betting that this can somehow be contained. It smacks of delusion.

Italy has progressed from pre-insurrectional anger to outright revolt. Insouciant markets are betting that this can somehow be contained. It smacks of delusion.

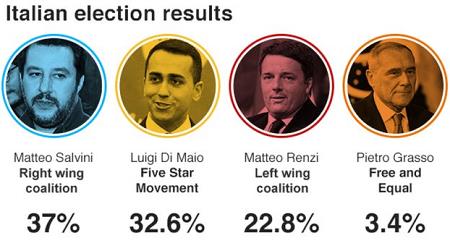

Risk spreads on Italian 10-year bonds are exactly where they were a week ago before the "anti-system" parties of Left and Right swept away the post-War establishment. The euro has shrugged off the vote entirely, rising 2% against the dollar since the earthquake.

Investors are acting as if they think Italy’s "poteri forti" and its eternal mandarin class will organize another technocrat government regardless of what has happened, or that the Five Star Movement’s Luigi Di Maio will cobble together a co-opted centre-Left coalition that scarcely differs from the last one.

Now damage control has begun. Praise is suddenly effusive for the elegant choir-boy leader Di Maio sitting on 33% of the vote. “Five Star does not frighten us, we have lived through worse,” the business lobby Confindustria says.

This is to play down the genesis of the Five Star phenomenon and the party’s avowed intent to push an eclectic anti-capitalist agenda inspired by the neo-Marxist writings of Thomas Piketty. The markets are singing in the dark.

US FRACKERS ARE THE SKUNKS AT THE PUTIN-OPEC GARDEN PARTY

The OPEC cartel is to forge a permanent alliance with a Russia-led bloc of producers by the end of the year, aiming to regain control of the world crude market with a super-combine of unprecedented scale and reach.

The OPEC cartel is to forge a permanent alliance with a Russia-led bloc of producers by the end of the year, aiming to regain control of the world crude market with a super-combine of unprecedented scale and reach.

Suhail al-Mazroui, OPEC’s president, said the two groups are working on a “framework partnership” that would tie them together closely in perpetuity after their current deal to cap production jointly expires later this year.

The new super-cartel would once have been a radical development for the oil industry. Today it’s an awkward and belated response to the threat of America’s "short-cycle" shale frackers, who can respond with lightning speed and are preventing the normal cycle of full recovery from taking hold.

The fracking industry seized on the "ROPEC" cuts to ramp up US output by over 250,000 b/d a month over the winter, with a further 1.3m b/d expected this year. This places Mr. Putin and Mr. al-Mazroui in a painful Catch 22.

THE DAVOS ELITE PREPARES TO BOW TO TRUMP

World Economic Forum, Davos, Switzerland. Team Trump stormed the fortress of the global elites on their first day (1/24) in Davos, defiantly accusing foes of blinding the world with free trade humbug and abusing the international trade system. Their boss arrives tomorrow (1/25) and delivers his keynote speech Friday (1/26).

World Economic Forum, Davos, Switzerland. Team Trump stormed the fortress of the global elites on their first day (1/24) in Davos, defiantly accusing foes of blinding the world with free trade humbug and abusing the international trade system. Their boss arrives tomorrow (1/25) and delivers his keynote speech Friday (1/26).

The US economic cabinet – Steve Mnuchin at Treasury, Wilbur Ross at Commerce, Rick Perry at Energy – said America has long been the victim of daily guerrilla warfare by trade hypocrites and is at last drawing its own sword in response, no longer willing to tolerate what it deems to be systematic gouging of the open US market.

“Trade wars are fought every single day: every single day there are always parties violating the rules and trying to take unfair advantage of things,” said Mr. Ross. “So a trade war has been in place for quite a little while. The difference is, US troops are now coming to the ramparts."

Mr. Ross denied that President Donald Trump is retreating into commercial isolation, insisting that the blizzard of 84 separate trade measures, probes and sanctions over the last year are a response to mercantilist abuses that have been tolerated for far too long.

“What has provoked a lot of the trade actions is inappropriate behavior on the part of our trading counter-parties. Many countries are good at the rhetoric of free trade but actually practice extreme protectionism, and that is a problem the president is quite determined to deal with."

CHINA FACES ITS MINSKY MOMENT

China’s central bank has warned in the clearest language to date that extreme credit creation and trouble in the shadow banking system could lead to a full-blown financial crisis.

China’s central bank has warned in the clearest language to date that extreme credit creation and trouble in the shadow banking system could lead to a full-blown financial crisis.

Zhou Xiaochuan, the governor of the People’s Bank (PBOC), spoke of “fierce market reactions” and a possible Minsky Moment, the tipping point when credit cycles break and euphoric booms collapse under their own weight.

It had long been assumed that this particular form of crisis cannot happen a state-run financial system where the banks are under Communist Party control.

Mr. Zhou told China Daily that asset speculation and property bubbles could pose a “systemic financial risk”, made worse by the plethora of wealth management products, trusts, and off-books lending. He warned:

“If there is too much pro-cyclical stimulus in an economy, fluctuations will be hugely amplified. Too much exuberance when things are going well cause tensions to build up. That could lead to a sharp correction, and eventually lead to a so-called Minsky Moment. That’s what we must really guard against.”

CATASTROPHE LOOMS FOR SPAIN

Top global banks and bond funds are increasingly alarmed by the secessionist showdown in Spain, fearing that Catalan leaders will declare unilateral independence within days and set off a dangerous chain-reaction.

The link is to the horrific bloody violence perpetrated by Spanish police upon unarmed Catalans simply trying to vote. Here’s another. Twitter feeds such as #SpainOutOfEU, #ShameOnSpain, #CatalanReferendum have numerous videos of the unbelievable brutality on Sunday (10/01).

Those old enough to remember the Spanish Civil War can only shudder at TV footage of crowds across Spain cheering units of Guardia Civil for beating up defenseless Catalans, egged on with chants of “go get them.”

On Monday, hundreds of thousands of Catalans marched in the streets demanding full independence from Spain. Yesterday (10/03), Catalan President Carles Puigdemont told BBC that Catalonia will declare independence “within a matter of days.”

Events on the ground are moving with lightning speed.

IS A DOLLAR SURGE ON THE WAY?

The US Treasury and the Federal Reserve are both poised to start draining liquidity from the financial system, threatening a bout of dollar scarcity and a potential shake-up of currency markets over coming months.

The US Treasury and the Federal Reserve are both poised to start draining liquidity from the financial system, threatening a bout of dollar scarcity and a potential shake-up of currency markets over coming months.

The twin-shift in policy is likely to tighten the availability of credit and send a strong impulse through Wall Street and global bourses, though whether it will be powerful enough to dampen frothy asset prices in the current exuberant mood is an open question.

“As we approach the fourth quarter, dollar scarcity could return as a theme. The upcoming tightening of US liquidity is not fully reflected in market pricing,” says Christin Tuxen and Jens Naervig Pedersen from Danske Bank.

What makes the US Treasury actions doubly-potent this time is that the Fed is about to pull the trigger on ‘quantitative tightening’ (QT) at exactly the same time, taking the first steps to wind down its $4.4 trillion balance sheet after almost a decade of ultra-stimulus.

"This will not be a walk in the park," says Danske Bank.

DO NOT BET AGAINST TRUMP OR THE DOLLAR

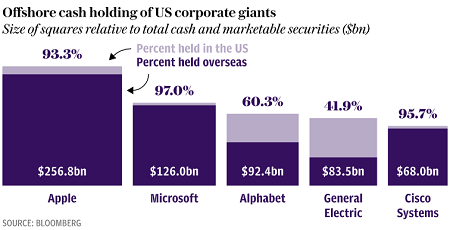

Donald Trump's appetite is whetted. He knows that American companies have stashed trillions of dollars overseas in what amounts to the greatest cash reserve in the world.

Donald Trump's appetite is whetted. He knows that American companies have stashed trillions of dollars overseas in what amounts to the greatest cash reserve in the world.

Apple has $257bn parked abroad beyond the reach of the Internal Revenue Service. Alphabet (Google) has $126bn, Microsoft $84bn, Cisco $68bn, and Oracle $59bn. The US Bureau of Economic Analysis estimates that total retained earnings outside the country have mushroomed to $4 trillion.

The President is determined to lay his hands on this money, or at least to divert it back into the US economy. The latest briefings from Washington suggests that the White House is preparing 'mandatory' action as part of his tax reform, unlike the previous voluntary attempts to lure back money through tax holidays.

The President is determined to lay his hands on this money, or at least to divert it back into the US economy. The latest briefings from Washington suggests that the White House is preparing 'mandatory' action as part of his tax reform, unlike the previous voluntary attempts to lure back money through tax holidays.

If Mr. Trump succeeds, these repatriated capital flows will have a volcanic impact on the US dollar, Wall Street, and the global financial system, with big winners and big losers.

TRUMP AND VENEZUELA

Venezuela’s oil industry is at risk of sudden collapse as funding dries up and the US tightens sanctions, threatening to shatter the beguiling calm in global crude markets.

Venezuela’s oil industry is at risk of sudden collapse as funding dries up and the US tightens sanctions, threatening to shatter the beguiling calm in global crude markets.

West Texas crude briefly spiked above $50 a barrel for the first time since late May after Venezuelan leader Nicolas Maduro pressed ahead with a rigged election on Sunday (7/30) in defiance of the US, the EU, and the leading Latin American powers.

President Donald Trump threatened “strong and swift economic sanctions” before the weekend vote. On Monday (7/31), Washington followed through and imposed personal sanctions on Mr. Maduro but this is essentially gesture politics.

Mr. Trump's own credibility is now on the line as the 'Chavista' revolution throws down the gauntlet.

Edwin Morse and Tina Fordham from Citigroup say a political showdown with Washington is now almost unavoidable. A core feature of the emerging ‘Trump Doctrine’ is “the sanctity of red lines”. This White House vows to deliver on its threats, insisting that it will not waver as Barack Obama did over Syria.

IS THE EU ON EUROPE’S SIDE OR RUSSIA’S?

A raft of top European companies will be forced to pull out of the Nord Stream 2 gas pipeline project with Russia or face crippling sanctions under draconian legislation racing through the US Congress.

Berlin and Brussels have threatened retaliation if Washington presses ahead with penalties on anything like the suggested terms, marking a dramatic escalation in the simmering trans-Atlantic showdown over America’s extra-territorial police powers.

A consortium of Shell, Engie, Wintershall, Uniper, and Austria’s OMV is providing half the $11 billion funding for the 760-mile pipeline through the Baltic Sea to Germany. “This is a spectacular interference in internal European affairs,” says Isabelle Kocher, the director-general of Engie in France.

There are many voices in Europe, however, who see Nord Stream 2 as spectacular collusion between Berlin/Brussels and the Kremlin. Here’s how it’s easy to see why.

CHINA IS RIDING A TIGER IT CANNOT GET OFF

China’s authorities are increasingly worried by stress in the country’s financial system and the sudden slowdown in economic growth, fearing that it may now be too dangerous to press ahead with their draconian crack-down on shadow banking.

The People’s Bank (PBOC) began signaling late last week that it would soften its assault on the credit markets, shifting instead to pro-growth policies and efforts to prevent a liquidity shock before the Communist Party’s 19th Congress in November.

Then on Sunday (5/15), Premier Li Keqiang told the International Monetary Fund that regulatory overkill would be a mistake at this delicate juncture. The state media says “financial stability” is now deemed a greater priority than efforts to control debt.

“They are spooked. They know that shadow banking is running amok but they are not really willing to follow through and take the leverage out of the system,” says George Magnus from the China Centre at Oxford University. “This is their Achilles Heel. It is very similar to what happened in the West in 2005 to 2006.”

HOW CAN AMERICA AND CHINA SUPPORT A WORLD OF DEBT?

Equity investors across the world are positioned for the nirvana of synchronized and accelerating global expansion led by China and the US.

Equity investors across the world are positioned for the nirvana of synchronized and accelerating global expansion led by China and the US.

What they may instead get is a synchronized Sino-American slap in the face. Analysts at UBS say the international credit impulse has already "collapsed". The two economic superpowers are both tightening policy into an approaching storm.

There has been a steady drip-drip of hard facts that support the fears. The $12.5 trillion market for US bank credit has sputtered out, for example, with flat growth over the last three months. Commercial and industrial loans are falling at the fastest rate since the Lehman crisis.

The latest Chinese mini-boom has been a wonder to behold. We can now see that the authorities panicked after the economy hit a wall in early 2015. They abandoned reform and reverted to extreme debt creation, pushing corporate debt to 171% of GDP.

The key question the world must face now is where the pain threshold lies for a dollarized global system that is more leveraged than at any time in market history. The Institute of International Finance says global debt has reached $217 trillion, a record ratio of 325% of world GDP.

THE FRENCH ARE DETERMINED TO MAKE THEIR COUNTRY UNGOVERNABLE

The Le Pen challenge of 2017 is dead. Emmanuel Macron will have no trouble erecting a ‘cordon sanitaire’ to keep her Front National at bay in round two of the French elections on May 7.

The existential threat hanging over Europe’s monetary union has for now been lifted. Markets have instantly pocketed the reprieve. The spread between French 10-year bonds and German Bunds has dropped to ‘pre-populism’ levels of just over 40 basis points.

The celebration may be short-lived. “France is going to be very difficult to govern,” observes Eric Dor from the IESEG school of management in Lille. You can’t put it more mildly than that.

“The National Assembly [French Parliament] may be badly Balkanized and nobody knows whether Macron will have a working majority. The fear is that France could lose another five years,” he says. Just five years? How about forever?

THE SAFE HAVEN OF BRITAIN AMIDST THE WOES OF EUROPE

On Tuesday (4/18) to the surprise of many, British Prime Minister Theresa May called for an early or “snap” General Parliamentary Election. It was a very smart move.

Assuming – as does most everyone – that her Conservative Party wins a landslide victory on June 8, Theresa May will be the only leader of a major EU state with a crushing mandate and the backing of a unified parliamentary phalanx.

All others will be in varying states of internal disarray. None will have a workable majority in their parliaments. Bitter internal disputes will continue to fester over the loss of democratic control under monetary union, whether or not euroskeptic parties actually come to power.

This gives the Prime Minister formidable clout. We have moved a long way from the first chaotic weeks after the Brexit referendum last June. The tables have since turned.

Britain will enter the Brexit talks led by an ancient and disciplined party of great governing credibility, while grave discord lies on the other side of the Channel, whether in France, Germany, Italy or elsewhere.

KING DOLLAR AND THE CHINESE DEATH SPIRAL

Lake Como, Italy. The world's leading currency institute is bracing for a dramatic rise in the US dollar as the Federal Reserve rushes to tighten monetary policy, setting the stage for a protectionist showdown and a fresh debt crisis in emerging markets.

Lake Como, Italy. The world's leading currency institute is bracing for a dramatic rise in the US dollar as the Federal Reserve rushes to tighten monetary policy, setting the stage for a protectionist showdown and a fresh debt crisis in emerging markets.

Adam Posen, president of the Peterson Institute for International Economics, says investors have badly misjudged the confluence of forces at work in Washington.

They wrongly assume that fiscal stimulus will come to little under Donald Trump, and are equally wrong that Janet Yellen Fed's will remain dovish as the US nears full employment.

"We expect the dollar to rise by another 10% to 15%. The concern is that this will suck capital out of the more fragile emerging markets and lead to fresh capital outflows from China," Mr. Posen said in his speech at the Como Forum for international economists. It will greatly exacerbate the already massive problems that are sucking the life-blood out of the Chinese economy.

THE FRACKING TIGER IS EATING THE RUSSIAN BEAR ALIVE

The US shale industry has become a hydra-headed monster for Russia – and OPEC too. Before they have contained one threat, fresh dangers keeps popping up in new and expanding zones.

The US shale industry has become a hydra-headed monster for Russia – and OPEC too. Before they have contained one threat, fresh dangers keeps popping up in new and expanding zones.

This war of attrition in the crude markets is lasting far longer and biting deeper than the energy exporting states ever imagined. It profoundly alters the geo-strategic contours of energy, and the global balance of power.

New technology is reviving old US fields already written off as largely exhausted, and in the latest twist the impetus is spreading to 'super-basins' in Latin America that threaten to replicate the US success story in short order.

"The tiger is out of the cage and it is going to be very hard to put it back in again," says Gerald Kepes, upstream chief for IHS Markit. "There are multiple basins that could really take off." Yes, out of the cage and eating the Russian bear alive.

THE BOTTOM LINE QUESTION FOR THE YELLEN FED

On three separate occasions since 2013, the US Federal Reserve sent shock waves through the global financial system when it tried to tighten monetary policy, and each time it was forced into partial retreat to halt the mayhem.

Over recent months the Federal Open Market Committee has been careful to take the global pulse before acting. It now hopes the coast is clear. Yesterday's (3/15) quarter point rise in the federal funds rate to 1% has been so loudly signaled in advance that investors have already adjusted.

Emerging markets seem better prepared, so far able to shrug it off. China has restored confidence in its exchange rate regime. Capital flight appears to be under control. Europe's shift towards bond tapering reduces the risk of a rocketing dollar. "We're not overly worried about downside shocks," said Janet Yellen, the Fed chairman.

Yet nobody really knows whether the world can handle a total of six rate rises over the course of 2017 and 2018 as sketched in the Fed's 'dot plots' scenario.

RUSSIA AND OPEC ARE PERMIANENTLY FRACKED

The OPEC oil cartel – and Putin’s Russia – are waking up to an unpleasant surprise. Shale output from the Permian Basin in Texas is expanding faster than the world thought humanly possible.

The scale threatens to neutralize output cuts agreed by Saudi Arabia and a Russian-led bloc last November, and ultimately threatens break their strategic lockhold on the global crude market for a generation.

"People just don't seem to realize how big the Permian is. It will eventually pass the Ghawar field in Saudi Arabia, and that is the biggest in the world," said Scott Sheffield, founder of Pioneer Natural Resources and acclaimed 'King of the Permian'.

Fresh science broadly confirms the once-outlandish claims of Mr. Sheffield and the veteran wildcatters. Consultants IHS have tripled their estimate of ultimate recoverable resources in the Permian to 104bn barrels – recoverable now due to astonishingly rapid advances in American fracking technology.

FRACKING OPEC

The short-lived recovery of world oil prices is already in danger as OPEC and Russia fail to deliver on agreed output cuts and America’s shale industry roars back to life.

“All hell is going to break loose if they don’t extend the deal beyond June,” says Tamas Varga from brokers PVM Oil Associates.

Resurgent shale output in the US leaves OPEC and Russia facing a Sisyphean task. America’s frackers have cranked up output faster than OPEC thought possible, and on a large enough scale to alter the global balance of supply and demand.

Rising US crude stocks are a cautionary warning at a time when funds are betting heavily on a fresh oil boom, with ‘long’ contracts running at 812,000 lots. This is higher than at any time in the last five years and is approaching record levels, raising the risk of “liquidation” by investors.

MARINE LE PEN – THE FRENCH DONALD TRUMP

If Marine Le Pen wins France's presidential elections in May, all talk of punishing Britain for the outrage of Brexit will become irrelevant.

French diplomacy will pirouette overnight under a National Front (FN) leader. The Élysée Palace will seek an Entente Cordiale with the British, offering a bilateral alliance on new foundations.

It will then be the European Union that faces an existential choice: whether to reinvent itself as a loose federation of nation states, or succumb to galloping disintegration

"What is the point in punishing a country? It is senseless, unless you think the EU is a prison, and you are condemned if you escape. I want to rebuild our damaged relations with the United Kingdom," she told me in an interview yesterday (02/15).

"France is the political heart of Europe, and the moment we leave the euro the whole project collapses," said Ms Le Pen, as she leans across the table in her tiny office in the European Parliament with a glint of mischief.

"A whole psychological framework is breaking down. I think 2017 is going to be the year of the grand return of the nation state, the control of borders and currencies," she said. Hearing her, you can’t help but think of Donald Trump.

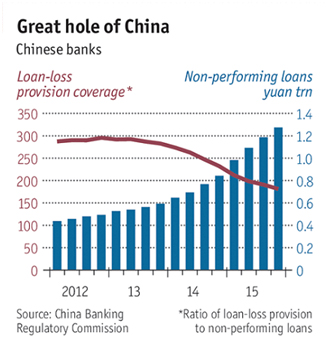

THE GREAT HOLE OF CHINA

China’s central bank is running out of ways to stem capital flight and faces a near impossible task trying to manage the fall-out from extreme credit growth, two of Asia’s most influential banks have warned.

China’s central bank is running out of ways to stem capital flight and faces a near impossible task trying to manage the fall-out from extreme credit growth, two of Asia’s most influential banks have warned.

“Defense of the currency by the People’s Bank (PBOC) is no longer a viable option,” says Eric Robertson, the head of global macro strategy for Standard Chartered.

Standard Chartered has been in the China since the 1850s and has over 6,000 staff in the country. Its warnings should not be taken lightly.

The Asia-focused lender says powerful forces are driving capital out of the country and the picture is fundamentally more disturbing than it was during last year’s devaluation panic. This is putting the PBOC in an invidious position as it attempts to deal with festering troubles in the banking system.

While the PBOC still has $3 trillion of foreign exchange reserves, they are not as large as they look given the scale of the financial pressures and the structure of the Chinese economy. The ratio of the M2 money supply to reserves has collapsed to a 15-year low and this may prove to be the crucial ratio in a confidence crisis.

TRUMP IS RIGHT: GERMANY WORSE THAN CHINA

As a matter of strict objective fact, Donald Trump’s trade guru Peter Navarro is correct. Germany is the planet’s ultimate currency manipulator, not China.

The Euro – really a de facto Deutsche Mark – is indeed “grossly undervalued.” The warped mechanism of monetary union allows Germany to lock in a permanent ‘beggar-thy-neighbor’ trade advantage over Southern Europe, inflicting mass unemployment on the victim countries and blighting their futures.

Whatever you think of Peter Navarro’s trade philosophy regarding China, he is right that Germany’s chronic, huge, and illegal current account surplus - 8.8% of GDP - saps global demand and seriously distorts the world economy.

And now, President Trump is going to do something about it.

WHY TIME IS RUNNING OUT FOR CHINA’S DEBT-DRIVEN BOOM

There is now no denying that China's economy is slowing sharply, though this can be masked by mini-booms along the way.

There is now no denying that China's economy is slowing sharply, though this can be masked by mini-booms along the way.

China is creating credit at twice the pace of underlying growth and is relying on hazardous bubbles to keep growth running far above the safe speed limit, Fitch Ratings has warned.

Short-term stimulus is papering over deep cracks in the economy and vital reforms are being neglected, storing up serious trouble for the future.

The Fitch credit agency said state control over the banking system will prevent a sudden collapse in confidence or a western-style financial crash, but the Communist authorities are running out of tools to meet their inflated GDP targets.

China's epic catch-up boom since the early 1980s will likely sputter out this year as banks struggle with the legacy of bad debts and chronic malinvestment. Here’s why.

DAVOS MAN IS SCARED AND WORRIED

It was Harvard professor Samuel Huntington who first hurled the epithet “Davos Man” at the new elites, railing against “gold-collar workers” with no use for the nation state, and divorced from organic societies rooted in tradition.

He warned of a cosmopolitan superclass of 20 million people, with interests diverging ever further from the anthropology of the parish. This rootless supra-culture was cornering the gains of the global economy, and capturing ideological power.

“They have little need for national loyalty, view national boundaries as obstacles that thankfully are vanishing, and see national governments as residues from the past whose only useful function is to facilitate the elite’s global operations,” he wrote.

Prof. Huntington has earned his posthumous vindication. The pull of the nation and ancestral memory is stronger after all. Everything that the World Economic Forum stands for on the eve of the 47th summit in Davos is palpably under threat.

GERMANY’S HORROR-KURVE

Inflation rage is coming to the boil in Germany. Leaders of the country's prestigious institutes warn that the economy is hitting capacity constraints and risks spiraling into a destructive boom-bust cycle.

Inflation rage is coming to the boil in Germany. Leaders of the country's prestigious institutes warn that the economy is hitting capacity constraints and risks spiraling into a destructive boom-bust cycle.

In a series of interviews with yours truly they said that the ultra-loose monetary policy of the European Central Bank is now badly out of alignment with German needs. It has begun to threaten lasting damage, and is fast undermining political consent for monetary union.

"The ECB wants to inflate away the debt of the southern European countries. This is a clear conflict of interest with net creditors like Germany," says Clemens Fuest, president of the IFO Institute in Munich.

The tabloid newspaper Bild Zeitung leapt on the latest price data, splashing with a "Horror-Kurve" showing inflation soaring to seemingly frightening heights.

An example is the UBS bubble index showing that Munich is now the fifth most expensive housing market in the world, with prices that have "increasingly lost touch with economic fundamentals.”

TRUMP AND THE THUCYDIDES TRAP

Donald Trump's assault on trade is escalating. First the foes were China and Mexico. Now it is the world.

The Trump transition team is now mooting an import tariff of 10% across the board, doubling down on earlier talk of a 5% duty. This is a sobering demarche. Such thinking is of a different character to Mr. Trump's campaign rhetoric, which mostly hinted at trade sanctions to force concessions.

The Trump transition team is now mooting an import tariff of 10% across the board, doubling down on earlier talk of a 5% duty. This is a sobering demarche. Such thinking is of a different character to Mr. Trump's campaign rhetoric, which mostly hinted at trade sanctions to force concessions.

A catch-all tariff is a change of belief systems. It overthrows the free trade order that has been upheld and policed by Washington since the 1940s.

Markets are still behaving as if they will get the "good Trump" (tax cuts and fiscal stimulus) rather than the "bad Trump" (trade wars), despite mounting evidence to the contrary.

In fairness to the Trump camp, we should not be beguiled too easily by free trade pieties, or fall for the canard that the Smoot-Hawley Tariff Act of 1930 caused the Great Depression. It could not possibly have done the damage so often claimed.

Nonetheless, it may be that Mr. Trump and his coterie in Washington are walking straight into the "Thucydides Trap" in their handling of China.

THE NEXT CHINESE BOOM HAS COME AND GONE

As the Dow flirts with Trumpian heights of 20,000 on Wall Street, the Shanghai Composite in China has been drifting down for seven consecutive weeks.

As the Dow flirts with Trumpian heights of 20,000 on Wall Street, the Shanghai Composite in China has been drifting down for seven consecutive weeks.

It is hard to construct a case that reconciles this split, given the tightly intertwined nature of the world's financial system and the trans-Pacific symbiosis that we call Chimerica. One of these two markets must reverse.

If you are waiting for the next Chinese boom, you have already missed it. The latest 18-month mini-cycle has peaked. The authorities are being forced to tighten. China's $9 trillion bond market is seizing up.

Forty companies have had to cancel or postpone bond issuance this month. Nomura says 24 large firms are in default negotiations, ranging from steel and construction to shipbuilding, chemicals, textiles, and solar.

Beijing let it rip earlier this year with a fiscal deficit of 4% of GDP - a one-off loosening of two to three percentage points that you would expect only in an emergency - and it deliberately stoked a housing bubble in the cities of the Eastern seaboard.

The stimulus was comparable in scale China's post-Lehman blitz, but the effects have been far less because the efficiency of credit has collapsed. It now takes four yuan of loans to generate one yuan of growth. Since there has been almost no underlying reform, this has merely bought time at the cost of greater imbalances.

IS CHINA POWERLESS AGAINST TRUMP?

On Fox News Sunday (12/11), with a single incendiary comment on Taiwanese independence, US president-elect Donald Trump has abrogated a central tenet of US foreign policy for the last 37 years and seems to have picked a deliberate fight with China.

On Fox News Sunday (12/11), with a single incendiary comment on Taiwanese independence, US president-elect Donald Trump has abrogated a central tenet of US foreign policy for the last 37 years and seems to have picked a deliberate fight with China.

Mr. Trump’s language ereyesterday was explicit: “I fully understand the ‘One China policy, but don’t know why we have to be bound by a One China policy unless we make a deal with China having to do with other things, including trade.” This is a bombshell.

The world’s two superpowers are now heading for a showdown on a neuralgic strategic issue, greatly raising the risk of a trade war and a fundamental breakdown of the global commercial system.

However…there is little that Beijing can do to damage the US without hurting itself far more. China’s financial options are limited. Veiled threats to detonate a US debt crisis by selling Beijing’s $1.157 trillion of US Treasury bonds, to take just one example, are mere bluster.

So what can China do regarding the wily presidential deal-maker?

THE ITALIAN JOB

Italy's Matteo Renzi thought the "silent majority" would save him, if only he could chivvy enough of them to polls. The prime minister misjudged disastrously.

The voters certainly turned out. They smashed through the 60% threshold that Mr. Renzi thought would secure him victory in the constitutional referendum, but only to register their silent anger - with him, with his government, with Brussels, and with an Italo-European establishment that has run the Italian economy into the ground.

"I didn't realize they hated me so much," he confessed before his resignation, the wunderkind of European politics no more.

The referendum was no ordinary vote and it may prove much harder this time to shrug off the volcanic effects. "The whole world was against us. They threw every piece of [expletive] at us. Our achievement is a miracle," said Beppe Grillo, the flamboyant comedian behind the triumphant Five Star Movement.

A narrow 'No' had been discounted. Almost nobody expected a landslide rejection by 59% to 41%, with reaching 71% in Sicily in what amounts to a primordial scream by the pauperized Mezzogiorno.

THE GLOBAL FINANCIAL EARTHQUAKE OF A TRUMP DOLLAR

The soaring US dollar is causing mounting strains for the global financial system and ultimately threatens to set off a f ull-blown banking crisis in emerging markets, the world’s top’s economic watchdog has warned.

ull-blown banking crisis in emerging markets, the world’s top’s economic watchdog has warned.

“We have all the symptoms of a dollar shortage,” said Hyun Song Shin, chief economist at the Bank for International Settlements (BIS).

The warning came as the closely-watched dollar index (DXY) appeared close to breaking through key resistance levels to a 14-year high, a move likely to trigger a stampede into the US currency as hedge funds and momentum traders join the chase.

The danger is that the powerful and immediate effects of financial tightening will “swamp” any trade benefits for the rest of the world from Donald Trump’s stimulus plans and a stronger dollar, even for countries that export heavily to the US. “It may not be very good news for anyone,” Mr. Shin told a specialist forum at the London School of Economics.

The BIS estimates that dollar debt outside US jurisdiction - and therefore lacking a direct lender of last resort - has risen five-fold to $10 trillion over the past 15 years. The great unknown is what will happen to China, where corporate debt has mushroomed to 145% of GDP.

THE WORLD RUNS OUT OF DOLLARS

Surging rates on dollar Libor contracts are rapidly tightening conditions across large parts of the global economy, incubating stress in the credit markets and ultimately threatening overvalued bourses.

Surging rates on dollar Libor contracts are rapidly tightening conditions across large parts of the global economy, incubating stress in the credit markets and ultimately threatening overvalued bourses.

Three-month Libor rates – the benchmark cost of short-term borrowing for the international system – have tripled this year to 0.88% as inflation worries mount.

Fear that the US Federal Reserve may have to raise rates uncomfortably fast is leading to an acute dollar shortage, draining global liquidity.

“The Libor rate is one of few instruments left that still moves freely and is priced by market forces. It is effectively telling us that that the Fed is already two hikes behind the curve,” says Steen Jakobsen from Saxo Bank. “Something more fundamental is at work. The cost of global capital is going up, full stop.”

“This is highly significant and is our number one concern. Our allocation model is now 100% in cash. This is a warning signal for the market and it happens extremely rarely,” he says.

THE COMING CHINESE DEVALUATION DISASTER

China's property market went mad after the authorities poured fuel on the flames. Beijing is now slamming on the brakes.

China's property market went mad after the authorities poured fuel on the flames. Beijing is now slamming on the brakes.

Capital outflows from China are accelerating. The hemorrhage has reached the fastest pace since the currency panic at the start of the year.

The latest cycle of credit-driven expansion has already peaked after 18 months. Beijing has had to slam on the brakes, scrambling to control property speculation that the Communist authorities themselves deliberately fomented.

The central bank (PBOC) spent roughly $50bn defending the yuan last month, but this has not stopped the exchange rate sliding to 6.77 against the dollar - the weakest in six years.

"Our view is that the RMB (yuan) will depreciate 20% against the US dollar to 8.1 by the end of 2018 as deflation of the property bubble leads to more capital outflows," says Zhiwei Zhang from Deutsche Bank. "This is deflationary for global trade."

That is an understatement. A Chinese devaluation on this scale would be an earthquake for the world's economic and financial system, unleashing a tsunami of cheap manufacturing exports into Europe and the US. The world cannot absorb the consequences of so much excess.

SANDSTORM OVER THE HOUSE OF SAUD

Saudi Arabia has injected $5.3bn of liquidity into the banking system to stave off a financial crunch as the oil slump drags on and capital continues to leak out the country. This just as the US Congress overrides Obama’s veto allowing 9/11 families to sue the Kingdom.

Three-month interbank offered rates in Riyadh - the stress gauge watched by traders - have reached the highest since the Lehman crisis, ratcheting up 145 basis points over the last year.

The M3 money supply has contracted by 8% in twelve months. The loan-to-deposit ratio has already blown through the government's safety ceiling of 90%, touching an all-time high.

"Deposits are falling and liquidity has been tightening for month after month," says Patrick Dennis from Oxford Economics.

Foreign exchange reserves have slipped to $550bn from a peak of $746bn as the regime sells off the family silver to pay the bills. The International Monetary Fund says the budget deficit reached 15.9% of GDP last year and will be an estimated 13% this year.

The reserve loss automatically tightens monetary policy and can be painful. Fitch Ratings said there may have to be a state bail-out of construction firms sinking into deeper trouble. The Bin Laden Group is laying off 77,000 workers.

CHINA IS NOW THE EPICENTER OF GLOBAL RISK

China has failed to curb excesses in its credit system and faces mounting risks of a full-blown banking crisis, according to early warning indicators released by the world’s top financial watchdog.

A key gauge of credit vulnerability is now three times over the danger threshold and has continued to deteriorate, despite pledges by Chinese premier Li Keqiang to wean the economy off debt-driven growth before it is too late.

The Bank for International Settlements – the central bank of central banks, based in Basel, Switzerland – warns in its September 2016 quarterly report that China’s "credit to GDP gap" has reached 30.1, the highest to date and in a different league altogether from any other major country tracked by the institution.

It is also significantly higher than the scores in East Asia's speculative boom on 1997 or in the US subprime bubble before the Lehman crisis.

Studies of earlier banking crises around the world over the last sixty years suggest that any score above 10.0 requires careful monitoring. The credit to GDP gap measures deviations from normal patterns within any one country and therefore strips out cultural differences.

China is now the epicenter of global financial risk. Why? Because the Chinese banking system is an arm of the Communist Party.

THE DANGER OF JAPAN AND THE EU TO THE GLOBAL ECONOMY

The growth rate of nominal GDP in the US has fallen to 2.4%, the lowest level outside recession since the Second World War.

The growth rate of nominal GDP in the US has fallen to 2.4%, the lowest level outside recession since the Second World War.

It has been sliding relentlessly for almost two years, a warning signal that underlying deflationary forces may be tightening their grip on the US economy.

Given this extraordinary backdrop, the violent spike in US and global bonds yields since last week is extremely odd. It is rare for AAA-rated safe-haven debt to fall out of favor at the same time as stock markets, and few explanations on offer make sense.

We can all agree that oxygen is thinning as we enter the final phase of the economic cycle after 86 months of expansion. The MSCI world index of global equities has risen to a forward price-to-earnings ratio of 17, significantly higher than on the cusp of the Lehman crisis.

Nonetheless, the Fed cannot plausibly be responsible for the global bond rout. What is true is that markets fear the Bank of Japan and the European Central Bank are reaching their political limits, and may not be allowed to press ahead with their experiments even if they want to.

THE ALMIGHTY DOLLAR

The US dollar is tightening its grip on the global financial system at the expense of the euro, entrenching American hegemony and rendering the US Federal Reserve more powerful than at any time in history.

The US dollar is tightening its grip on the global financial system at the expense of the euro, entrenching American hegemony and rendering the US Federal Reserve more powerful than at any time in history.

Newly-released data from the Bank for International Settlements (BIS) show that the dollar’s share of the $5.1 trillion in foreign exchange trades each day has continued rising to 87.6% of all transactions.

It is the latest evidence confirming the extraordinary resilience of the dollar-based international order, confounding expectations of US financial decline a decade ago.

Roughly 60% of the global economy is either in the dollar zone or closely tied to it through currency pegs or ‘dirty floats’, and the level of debt issued in dollars outside US jurisdiction has soared to $9 trillion.

This has profound implications for monetary policy. The Fed has become the world’s central bank whether it likes it or not, setting borrowing costs for much of the global system.

CHINA’S DEAD MONEY TRAP

China is at mounting risk of a Japanese-style "liquidity trap" as monetary policy loses traction and the economy approaches credit exhaustion, forcing a shift towards Keynesian fiscal stimulus.

Officials at the Chinese People’s Bank (PBOC) have begun to call for a fundamental change in strategy, warning that interest rate cuts have become an increasingly blunt tool. They cannot easily stop companies hoarding cash or halt the slide in private investment.

Sheng Songcheng, the PBOC’s head of analysis, set off a storm last month by warning that the economy had “started to show some signs of being caught in a liquidity trap.”

Caixin magazine said last week (8/16) Chinese companies are hoarding record sums of “dead money” rather than spending it. The growth rate of private investment has dropped to 2.1% over the last seven months, the lowest since global financial crisis.

The International Monetary Fund warned in June that China’s corporate debt has reached 145% of GDP. “Vulnerabilities are still rising on a dangerous trajectory. They must be addressed immediately,” it said. China’s entire financial system is clearly out of kilter.

THE EPIC SAUDI FAIL AND THE TRIUMPH OF AMERICAN INGENUITY

OPEC's worst fears are coming true. Twenty months after Saudi Arabia took the fateful decision to flood world markets with oil, it has still failed to break the back of the US shale industry.

The Saudi-led Gulf states have certainly succeeded in killing off a string of global mega-projects in deep waters. Investment in upstream exploration from 2014 to 2020 will be $1.8 trillion less than previously assumed, according to consultants IHS. But this is a bitter victory at best.

America's hydraulic frackers are cutting costs so fast that most can now produce at prices far below levels needed to fund the Saudi welfare state and its military machine, or to cover OPEC budget deficits.

Scott Sheffield, the outgoing chief of Pioneer Natural Resources, threw down the gauntlet last Thursday (7/28) -- claiming that his pre-tax production costs in the Permian Basin of West Texas have fallen to $2 a barrel.

"Definitely we can compete with anything that Saudi Arabia has. We have the best rock," he said. Revolutionary improvements in drilling technology and data analytics that have changed the cost calculus faster than almost anybody thought possible.

Join the forum discussion on this post

Join the forum discussion on this post