Ambrose Evans-Pritchard

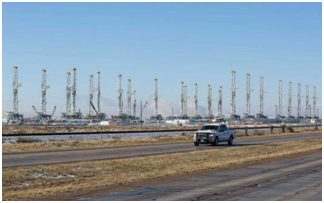

OIL IS HERE TO STAY AND SO IS THE GLOBAL ECONOMY

Oil rigs in the Permian Basin of Texas are still being built even at $45 oil, defying shale skeptics

Oil rigs in the Permian Basin of Texas are still being built even at $45 oil, defying shale skeptics

Oil prices have tumbled to a three-month low as surging supply once again exposes the chronic global glut and threatens to perpetuate the energy slump for another year.

US crude contracts crashed through key technical barriers to $42.40 yesterday (7/26) before recovering slightly in late trading on profit-taking. They have fallen by 9% over the last four sessions.

Speculators have given it an extra push. Data from the Commodity Futures Trading Commission in the US shows that 52 hedge funds have taken out large short positions, betting that the summer sell-off still has a further leg to run.

Prices are unlikely to re-test the February lows of $26 when asset prices were tumbling across the world and markets were in a full-blown ‘China panic,’ pricing in a global recession that never happened.

The latest oil tremors reveal little about the underlying health of the global economy, which has so far shrugged off Brexit fears and may be accelerating.

THE WORLD KNOWS TODAY BEIJING IS THE PROBLEM IN THE SOUTH CHINA SEA

The South China Sea has become the most dangerous fault-line in the world. Beijing and Washington are on a collision course over these contested waters, the shipping lane for 60% of global trade.

The South China Sea has become the most dangerous fault-line in the world. Beijing and Washington are on a collision course over these contested waters, the shipping lane for 60% of global trade.

To The Point has been predicting this for years. The prescience of that prediction became quite clear today.

This morning (7/12), the International Court of Justice in The Hague has ruled against China, that it has no “historic title” to areas of this sea stretching all the way to the ‘nine dash line’ - deep into the territorial waters of a ring of South East Asian states.

Beijing has as expected dismissed the verdict with scorn, accusing the tribunal of “shamelessly abusing its authority.” The state media said the country “must be prepared for any military confrontation” with the US, and must not flinch from war if provoked.

It is the latest in a series ominous developments in Asia and Europe that are rapidly subverting the Western international system and setting off a global rearmament race with strong echoes of the late-1930s.

THE FRENCH BREXIT BACKLASH BLUFF

French leaders are openly plotting to peel off large chunks of the City’s financial industry as soon as Britain leaves the EU. This might prove much tougher than they imagine.

France is rolling out the red carpet for putative refugees from Canary Wharf, hoping to capture the lion’s share of the estimated €600bn to €1 trillion market for clearing in euro-denominated transactions. Some German officials are also eyeing the City, but more discreetly.

"There is a power play going on. It is very clear France and Germany will do everything they can to damage the City and get the business for themselves," says Professor Athanasios Orphanides, a former member of the European Central Bank's governing council.

"Whatever they try to do, they'll end up shooting themselves in the foot and driving the businesses out Europe. The EU regulations are so costly that I think the City could actually see long-term benefits from leaving," he says.

The City is ranked number one in the Global Financial Centres Index, ahead of New York, Singapore, Hong Kong, Tokyo, and Zurich. None of the EU's other hubs come close. Luxembourg is 14, Frankfurt is 18, and Paris lags far behind at 32, behind Calgary or Dalian in China.

ITALY IS THE FIRST BREXIT DOMINO

Italy is preparing a €40bn rescue of its financial system as bank shares collapse on the Milan bourse and the powerful after-shocks of Brexit shake European markets.

An Italian government task force is watching events hour by hour, pledging all steps necessary to ensure the stability of the banks. “Italy will do everything necessary to reassure people,” said premier Matteo Renzi.

“This is the moment of truth we have all been waiting for a long time. We just didn’t know it would be Brexit that set the elephant loose,” said a top Italian banker.

The share price of banks crashed for a second trading day, with Intesa Sanpaolo off 12.5%, and falls of 12% for Banka MPS, 10.4% for Mediobana, and 8% for Unicredit. These lenders have lost a third of their value since Britain’s referendum five days ago.

“When Britain sneezes, Italy catches a cold. It is the weakest link in the European chain,” said Lorenzo Codogno, former director-general of the Italian treasury and now at LC Macro Advisors.

THE MODI REVOLUTION STALLS IN INDIA

India’s bid to become the ‘economic super-tiger’ of Asia is in serious doubt after an assault on the independence of the central bank and failure to deliver on promised reforms.

The country has been the darling of the emerging market universe since the Hindu nationalist Narendra Modi swept into power in May 2014 promising a blitz of Thatcherite reform and a bonfire of the diktats, but key changes have been blocked in the legislature. The government has turned increasingly populist.

Matters have come to a head with the de facto ouster of Raghuram Rajan, the superstar governor of the Reserve Bank of India (RBI), rebuked for keeping monetary policy too tight. It is part of a pattern of attacks on central banks by politicians across the world, and the latest sign that the glory days of the monetary overlords are waning.

“This is ‘Rexit' – India’s equivalent of ‘Brexit. It looks very bad for India and will not go down well in financial markets. He was defeated by the crony capitalists up against him,” says Lord Desai from the London School of Economics.

WHY I WILL VOTE FOR BRITAIN TO LEAVE THE EU

With sadness and tortured by doubts, next week (6/23) I will cast my vote as an ordinary citizen for withdrawal from the European Union.

Let there be no illusion about the trauma of Brexit. Anybody who claims that Britain can lightly disengage after 43 years enmeshed in EU affairs is a charlatan or a dreamer, or has little contact with the realities of global finance and geopolitics.

Stripped of distractions, it comes down to an elemental choice: whether to restore the full self-government of this nation, or to continue living under a higher supranational regime, ruled by a European Council that we do not elect in any meaningful sense, and that the British people can never remove, even when it persists in error.

We are deciding whether to be guided by a Commission with quasi-executive powers that operates more like the priesthood of the 13th Century papacy than a modern civil service; and whether to submit to a European Court of Justice (ECJ) that claims sweeping supremacy, with no right of appeal.

The EU Project bleeds the lifeblood of the national institutions, but fails to replace them with anything lovable or legitimate at a European level. It draws away charisma, and destroys it. This is how democracies die.

THE PANIC OF ELITES IN EUROPE

France has turned even more viscerally eurosceptic than Britain over recent months, profoundly altering the political geography of Europe and making it impossible to judge how Paris might respond to Brexit, the referendum on which is two weeks away (6/23).

An intractable economic crisis has been eating away at the legitimacy of the French governing elites for much of this decade. This has now combined with a collapse in the credibility of the government, and mounting anger over immigration. Remind you of what’s happening in the US?

A pan-European survey by the Pew Research Center released today found that 61% of French voters have an “unfavorable” view of the European Union, compared to 48% in the UK.

A clear majority is opposed to “ever closer union” and wants powers returned to the French parliament, a finding that sits badly with the insistence by President Francois Hollande that “more Europe” is the answer to the EU’s woes.

“It is a protest against the elites,” said Professor Brigitte Granville, a French economist at Queen Mary University of London. “There are 5000 people in charge of everything in France. They are all linked by school and marriage, and they are tight.”

DOES CHINA’S LEADER WANT TO POP CHINA’S DEBT BUBBLE?

Nobody rings a bell at the top of the credit supercycle, to misuse an old adage. Except that this time somebody very powerful in China has done exactly that.

China watchers are still struggling to identify the author of an electrifying article in the official newspaper of the Chinese Communist Party, People's Daily, that declares war on debt and the "fantasy" of perpetual stimulus.

Written in a imperial tone, it commands China to break its addiction to credit and take its punishment before matters spiral out of control. If that means bankruptcies must run their course, so be it.

China's debt is approaching $30 trillion, 440% of China’s GDP of $6.8 trillion. Popping a debt bubble that gigantic could be catastrophic for the entire world’s global - and over-globalized - financial system.

THE SUMMER OF SHOCKS

Global fund managers have almost no faith in the latest stock market rallies around the world and have begun to fear the worst from Brexit, putting aside near record sums of money in cash as they brace for a ‘summer of shocks.’

Investors have already lost confidence in China’s economic rebound this year and are shunning British equities like the plague, fearing a financial crunch if Britain votes to leave the EU.

Bank of America’s monthly survey of funds shows that 27% now think Brexit is the biggest ‘tail-risk’ for the global economy, overtaking neuralgic concerns about a devaluation by China or a wave of defaults by Chinese companies.

Longstanding fears that central banks are running out of policy ammunition or risk ‘quantitative failure’ have slipped to third place. The new worry is ‘stagflation’ in the US, a toxic mix of slowing growth and rising inflation at the same time.

What is puzzling is that this mood of deep alarm conflicts with clear evidence of accelerating monetary growth worldwide, usually a harbinger of better times ahead.

THE EURO’S SUGAR RUSH IS ENDING

The eurozone’s short-lived recovery is already losing steam as stimulus fades and deep problems resurface, raising fears of yet another false dawn and a potential deflation trap if there is any external shock over coming months.

Since the end of November, the euro has steadily risen against the dollar from a low of 1.05 to 1.14 today (5/11). But the sugar rush is coming to an end.

Industrial output fell in 1.3% Germany and 0.3% in France in March as manufacturing stalled, confounding expectations for robust expansion. The relapse in a string of countries suggests that flash estimates of 0.6% GDP growth in the first quarter were too optimistic and may have to be cut.

“The recovery is not gaining any traction. I am really quite worried about another spasm of the debt crisis over the summer,” said Lars Christensen from Markets and Money Advisory.

The eurozone has been basking in a sweet spot over the last year, with stimulus from cheap oil, a weaker euro, ECB bond purchases, and an end to fiscal austerity, all coming together in a "perfect positive storm". “If that can’t produce growth, nothing will,” says Nouriel Roubini from New York University.

CAN THE SAUDIS REALLY PULL THIS OFF?

Saudi Arabia has launched a radical ‘Thatcherite’ shake-up to an avert economic crisis and prepare the kingdom for the post-carbon world, stunning analysts with claims that it could break reliance on oil within just four years.

Prince Mohammad bin Salman Al Saud, the country’s de facto ruler, vows to build a $3 trillion wealth fund and break onto the world stage as an investment superpower, the spearhead of an historic package of measures intended to bring the deformed economy kicking and screaming into the 21st Century.

Salman, a 31 year-old tornado determined to smash the status quo, has amassed immense power over the economy and defense that belies his title as deputy crown prince, filling the cabinet with modern technocrats and startling his sinecure cousins from the Al Saud family with the unfamiliar prospect of hard work.

The plan known as “Vision2030” aims to slash $80bn of wasteful spending each year and impose some degree of order on the kingdom’s chaotic finances with a consumption tax and fresh levies. Can the Saudi Prince really pull this off?

YOU CAN FORGET ABOUT CHINA OVERTAKING THE US ECONOMY

China panic has abated. The Shanghai Composite index of equities is back above 3,000. The much-feared devaluation never happened.

The yuan has strengthened against the dollar this year, to the consternation of Western tourists. Outflows of money have slowed as dollar debt is paid off and Chinese investors wind down 'carry trade' positions.

The International Monetary Fund has just raised its forecast for Chinese growth this year to 6.5%, insisting that it is still far too early to talk about a hard-landing.

Yet that is where the good news ends, for there is a poisonous sting in the tail. We can put away those charts projecting China's 'sorpasso', the moment when the country surpasses the US to become the world's biggest economy. It is not going to happen and here’s why. This is a horror story for real.

THE END GAME FOR JAPAN?

Lake Como, Italy. Japan is heading for a full-blown solvency crisis as the country runs out of local investors and may ultimately be forced to inflate away its debt in a desperate end-game, one of the world’s most influential economists has warned.

Olivier Blanchard, former chief economist at the International Monetary Fund, said zero interest rates have disguised the underlying danger posed by Japan’s public debt, likely to reach 250% of GDP this year and spiraling upwards on an unsustainable trajectory.

Speaking Monday (4/11) at the Ambrosetti Forum of world policy-makers on Lake Como, he said, “To our surprise, Japanese retirees have been willing to hold government debt at zero rates, but the marginal investor will soon not be a Japanese retiree.”

“If and when US hedge funds become the marginal Japanese debt, they are going to ask for a substantial spread,” he told me. Analysts say this would transform the country’s debt dynamics and kill the illusion of solvency, possibly in a sudden, non-linear fashion.

Prof. Blanchard did not elaborate on the implications of Japan’s woes for the global financial system, but they would surely be dramatic. Japan is still the world’s third largest economy by far. It is also the global laboratory for an ageing crisis that the rest of us will face to varying degrees.

ARE THE PANAMA PAPERS UNLEASHING A WITCH HUNT?

The secret world of offshore banks and money-laundering has been under the microscope ever since the financial crisis. Now it is the turn of lawyers, registrars, and the hidden network of facilitators.

The treasure trove of 11.5 million documents leaked – or more precisely stolen - from the Panama law firm Mossack Fonseca lifts the lid on the extraordinary practices of the global elites, and on the alleged services of off-shore legal cabinets for terrorist organizations, drug cartels, sanctions busting, and front companies of all kinds.

The files on 213,000 firms first slipped to the German newspaper Suddeutsche Zeitung and then shared with the International Consortium of Investigative Journalists (ICIJ) is the biggest data leak in history. It will have long-lasting ramifications.

The avalanche of allegations has barely begun. The red-hot dossier on US citizens has not even been released. Yet the scandal has already triggered a string of criminal investigations around the world, kicking off in Australia and New Zealand within hours.

The Panama firm has responded: “We believe there's an international campaign against privacy. Privacy is a sacred human right that is being eroded more and more in the modern world. Each person has the right to privacy, whether they are a king or a beggar.” Mossack Fonseca has a point.

YELLOW YELLEN?

In her speech to the Economic Club of New York yesterday (3/29), Fed Chair Janet Yellen vowed to move with extreme care before tightening monetary policy in the face of lingering global deflation and trouble in China.

She swatted aside vociferous hawks on the Fed’s voting committee (FOMC), more or less pledging to flood the economy with excess stimulus in order to guarantee a safety margin against any further deflationary shocks. Her dovish comments set off wild moves on the currency markets and a powerful relief rally on Wall Street.

Mrs. Yellen is taking a major gamble.

A chorus of critics have warned that the Fed is falling behind the curve as the labor market tightens and commodity prices start to firm again, fearing a repeat of the 1970s when the institution repeatedly found excuses to delay taking action on the grounds that there was still plenty of hidden slack in the economy.

“The longer the Fed dithers, the higher rates are eventually going, ” said Paul Ashworth from Capital Economics.

THE FED IS TRAPPED

Interest rates in the United States have fallen to minus 2% in real terms and are dropping into deeper negative territory with each passing month. This is a remarkable state of affairs.

It is clear that the US Federal Reserve is now trapped. The FOMC dares not tighten despite core inflation reaching 2.3% because it is so worried about tantrums in financial markets and about that other Sword of Damocles - some $11 trillion of offshore debt denominated in dollars, up from $2 trillion in 2000.

The Fed has been forced by circumstances to act as the world's central bank, nursing a fragile and treacherous financial system struggling with unprecedented leverage.

Average debt ratios are 36 percentage points of GDP higher than they were at the top of the pre-Lehman bubble in 2008, and this time emerging markets have been drawn into the quagmire as well by the spill-over effects of quantitative easing. Like it or not, the Fed is stuck with the task of cleaning up a global mess that is arguably of its own making.

The three big blocs of the world economy are all in a short-term cyclical upswing. My fear is that the Fed may have repeated the error made by Alan Greenspan during the East Asia crisis of 1998 when he slashed rates and held them too low for too long, fueling the dotcom bubble.

DOES THE RSCOIN SUPERCURRENCY MEAN THE DEATH OF BITCOIN?

British computer scientists have devised a digital crypto-currency in league with the Bank of England that could pose a devastating threat to large tranches of the financial industry, and profoundly change the management of monetary policy.

The proto-currency known as RSCoin has vastly greater scope than Bitcoin, used for peer-to-peer transactions by libertarians across the world, and beyond the control of any political authority.

The purpose would be turned upside down. RSCoin would be a tool of state control, allowing the central bank to keep a tight grip on the money supply and respond to crises. It would erode the exorbitant privilege of commercial banks of creating money out of thin air under a fractional reserve financial system.

“Whoever reacts too slowly to these developments is going to take it on the chin. They will lose their businesses,” said Dr. George Danezis, who is working on the design at University College London.

"My advice is that companies should play very close attention to what is happening, because this will not go away," he said. Layers of middlemen in payments systems face a creeping threat across the nexus of commerce, stockbroking, currency trading or derivatives. Many risk extinction over time.

BRAZIL’S FUTURE DISAPPEARS ONCE AGAIN

The dream of a Brics ascendancy has ended in sadness and squalor after the iconic figure of the era was seized by police at his home here, to the rapturous applause of Brazil’s stock exchange.

Luiz Inacio Lula da Silva, or “Lula” to the world, is sacrosanct no more. The once beloved president – and former Fiat car worker – who came to personify Brazil’s seeming rise to prosperity and global stature is under criminal investigation for his role in the ever-spreading Lava Jato (car wash) scandal.

So are his three sons, and his wife. “Nobody is above the law in this country,” said the lead prosecutor, Carlos Fernando dos Santos Lima.

The shock comes as Lula’s economic legacy turns to ruin. Output has been falling for most of the past nine quarters. It contracted 3.8% last year. The OECD expects another 4% fall this year, the deepest slump since national records began in 1901.

It is a cruel twist of fortune for those who thought Brazil had reached the premier league, with deep-sea oil reserves fit for an emirate, and a currency so strong that it cost more for a coffee in Sao Paolo than in Oslo, Tokyo, or Zurich in the glory days of 2008. Those days are gone, as is Brazil’s future yet again.

US SHALE REVOLUTION WILL RUIN RUSSIA, IRAN, AND OPEC

The current crash in oil prices is sowing the seeds of a powerful rebound and a potential supply crunch by the end of the decade, but the prize may go to the US shale industry rather OPEC, the world's energy watchdog has predicted.

America's shale oil producers and Canada's oil sands will come roaring back from late 2017 onwards once the current brutal purge is over, a cycle it described as the "rise, fall and rise again" of the fracking industry.

"Anybody who believes the US revolution has stalled should think again. We have been very surprised at how resilient it is," said Neil Atkinson, head of oil markets at the International Energy Agency.

Contrary to widespread assumptions, the IEA report said Saudi Arabia and the OPEC club will lose market share, treading water as North America and Brazil's "pre-salt" basin in the Atlantic account for most of the growth in global output by the early 2020s. Algeria, Venezuela, Nigeria and Indonesia are all going into decline.

Iran’s fields are 70 years old and on the wane, while Russia will be the biggest casualty of all.

THE $3 TRILLION OIL DEBT BUBBLE

The global oil industry is caught in a self-feeding downward spiral as falling prices cause producers to boost output even further in a scramble to service $3 trillion of dollar debt, the world’s top watchdog has warned.

The Bank for International Settlements fears that a perverse dynamic is at work where energy companies in Brazil, Russia, China and parts of the US shale belt are increasing production in defiance of normal market logic, leading to a bad “feedback-loop” that is sucking the whole sector into a destructive vortex.

“Lower prices have not removed excess capacity from the market, but instead may have exacerbated it. Production has been ramped up, rather than curtailed,” said Jaime Caruana, the general manager of the Swiss-based club for central bankers.

The findings raise serious questions about the strategy of Saudi Arabia and the core OPEC states as they flood the global crude market to knock out rivals in a cut-throat battle for export share. The process of attrition may take far longer and do more damage than originally supposed.

BRITAIN SHOULD PUT THE EU OUT OF ITS MISERY

You may have heard of the “Brexit” – Britain’s opportunity to leave the EU via a referendum. As early as this June, British voters will be asked this question: "Should the United Kingdom remain a member of the European Union or leave the European Union?"

The odds they will choose the latter greatly improved this week, with the United States slipping behind Great Britain to 11th place in the 2016 Global Index of Economic Freedom.

What is even more striking about the 2016 index released Monday (2/01) by the Heritage Foundation is the shockingly “unfree” state of the European Union.

Greece is 138th – between Bangladesh and Mozambique. Italy is 86th – between Morocco and Madagascar. France is 75th – between Kuwait and the Seychelles, and well behind Ghana and Kazakhstan.

Why would British want to be a part of this any longer?

OPEC AND THE SAUDIS CANNOT DEFEAT US SHALE

Hedge funds and private equity groups armed with $60 billion of ready cash are ready to snap up the assets of bankrupt US shale drillers, almost guaranteeing that America’s tight oil production will rebound once prices start to recover.

Daniel Yergin, founder of IHS Cambridge Energy Research Associates, says it is impossible for OPEC to knock out the US shale industry though a war of attrition even if it wants to, and even if large numbers of frackers fall by the wayside over coming months.

“The management may change and the companies may change but the resources will still be there,” he told me here at the World Economic Forum in Davos. The great unknown is how quickly the industry can revive once the global glut starts to clear - perhaps in the second half of the year - but it will clearly be much faster than for the conventional oil.

“It takes $10 billion and five to ten years to launch a deep-water project. It takes $10 million and just 20 days to drill for shale,” he notes. Do the math. OPEC cannot compete.

A GLOBAL DEBT DEFAULT?

The global financial system has become dangerously unstable and faces an avalanche of bankruptcies that will test social and political stability, a leading monetary theorist is warning.

On the eve of the World Economic Forum in Davos, Switzerland, here’s what William White, the Swiss-based chairman of the OECD's review committee and former chief economist of the Bank for International Settlements (BIS), told me:

"The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up. Debts have continued to build up over the last eight years (which) will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something.”

Mr. White says the Fed is now in a horrible quandary as it tries to extract itself from QE and right the ship again. "It is a debt trap. Things are so bad that there is no right answer. If they raise rates it'll be nasty. If they don't raise rates, it just makes matters worse," he says.

CHINA IS TRAPPED IN THE IMPOSSIBLE TRINITY

China is perilously close to a devaluation crisis as the yuan threatens to break through the floor of its currency basket, despite massive intervention by the central bank to defend the exchange rate.

The country burned through at least $120bn of foreign reserves in December, twice the previous record, the clearest evidence to date that capital outflows have reached systemic proportions.

“There is certainly a sense that the situation is spiraling out of control,” says Mark Williams, from Capital Economics.

China’s reserves have dwindled from $4 trillion to $3.33 trillion and are no longer far from the $2.6 trillion deemed to be the prudent threshold by the International Monetary Fund, given China’s $1.2 trillion dollar liabilities.

In economic parlance, China is trapped in what is known as the Impossible Trinity.

DOES SAUDI ARABIA HAVE A FUTURE?

Saudi Arabia is burning through foreign reserves at an unsustainable rate and may be forced to give up its prized dollar exchange peg as the oil slump Dr.ags on, the country’s former reserve chief has warned.

“If anything happens to the riyal exchange peg, the consequences will be dramatic. There will be a serious loss of confidence,” said Khalid Alsweilem, the former head of asset management at the Saudi central bank (SAMA).

Dr. Alsweilem, now at Harvard University's Belfer Centre, said the Saudi authorities have taken a big gamble by flooding the world with oil to gain market share and drive out rivals. “The thinking that lower oil prices will bring down the US oil industry is just nonsense and will not work.”

The dollar peg has been the anchor of Saudi economic policy and credibility for over three decades. A forced devaluation would heighten fears that the crisis is spinning out of political control, further enflaming disputes within the royal family.

The crisis is getting so out of control that some international observers are speculating that Saudi Arabia might not have much of a future at all.

DID OPEC JUST DIE?

The OPEC cartel is to continue flooding the world with crude oil despite a chronic glut and the desperate plight of its own members

Brent prices have tumbled $3 a barrel to below $41, US crude over $4 to below $38, as traders tried to make sense of the fractious OPEC gathering in Vienna last Friday (12/04), which ended with no production target and no guidance on policy. It reeked of paralysis.

Prices are poised to test lows last seen at the depths of the financial crisis in early 2009. The shares of oil companies plummeted in London, and US shale drillers went into freefall on Wall Street.

“Lots of people said OPEC was dead. OPEC itself has just confirmed it,” said Jamie Webster, head of HIS Energy. Instead, there is now a new world order of three and only three oil superpowers. Guess who they are…

THE BOND BLOODBATH

One by one, the giant investment funds are quietly switching out of government bonds, the most overpriced assets on the planet.

Nobody wants to be caught flat-footed if the latest surge in the global money supply finally catches fire and ignites reflation, closing the chapter on our strange Lost Decade of secular stagnation.

As of now (late November), roughly $6 trillion of government debt was trading at negative interest rates, led by the Swiss two-year bond at -1.046%. The German two-year Bund is at -0.4%.

The Germans and Czechs are negative all the way out to six years, the Dutch to five, the French to four and the Irish to three. Bank of America says $17 trillion of bonds are trading at yields below 1%, including most of the Japanese sovereign debt market.

This is a remarkable phenomenon given that global core inflation - as measured by Henderson Global Investor's G7 and E7 composite - has been rising since late 2014 and is now at a seven-year high of 2.7%.

Inflationistas in the West have been arguing for six years that the QE-fuelled monetary base is about to break out and take us straight to Weimar or Zimbabwe. They failed to do their homework on liquidity traps.

Yet their moment may soon be nigh. Catalysts are coming into place. Globalization is mutating in crucial ways.

FRANCE CHOOSES TO BEEF UP SECURITY & DEFENSE OVER BUDGET RULES

France has invoked emergency powers to sweep aside EU deficit rules and retake control over its economy after the terrorist atrocities in Paris, pledging a massive in increase and security and defense spending whatever the cost.

France has invoked emergency powers to sweep aside EU deficit rules and retake control over its economy after the terrorist atrocities in Paris, pledging a massive in increase and security and defense spending whatever the cost.

President Francois Hollande said vital interests of the French nation are at stake and there can be no further justification for narrowly-legalistic deficit rules imposed by Brussels. “The security pact takes precedence over the stability pact. France is at war,” he told the French parliament.

Defense cuts have been cancelled as far out as 2019 as the country prepares to step up its campaign to “eradicate” ISIS, from the Sahel in West Africa, across the Maghreb, to Syria and Iraq.

ROBOTS TAKE OVER GLOBAL ECONOMY IN A DECADE

Robots will take over 45% of all jobs in manufacturing and shave $9 trillion off labour costs within a decade, leaving great swathes of the global society on the historical scrap heap.

Robots will take over 45% of all jobs in manufacturing and shave $9 trillion off labour costs within a decade, leaving great swathes of the global society on the historical scrap heap.

In a sweeping 300-page report, Bank of America predicts that robots and other forms of artificial intelligence will transform the world beyond recognition as soon as 2025, shattering old business models in a whirlwind of “creative disruption”, with transformation effects ultimately amounting to $30 trillion or more each year.

THE DOOM OF CHINA’S DEMOGRAPHIC DESTINY

China’s Communist Party has scrapped its hated one-child policy (see Note below) in a bid to shore up political support, but the move comes far too late to avert a collapse of the workforce and a demographic crisis by the late 2020s.

All couples will be allowed to have a second child under new rules agreed at the party’s closely-watched 5th Plenum in Beijing. The ban on larger families in cities will remain despite pleas from Chinese academics for total freedom.

The policy shift will make no difference to the workforce for almost 20 years and by then China will already be in the full grip of a demographic crunch.

“They have merely moved to a two-child policy. The family planning authorities are still there, and there is still an apparatus of state power intruding into people’s intimate lives,” says Jonathan Fenby, a China veteran at Trusted Sources.

China may already have left it too late to ditch the one-child policy. Critics say the damage has been evident for years, leaving aside the traumatic suffering of poor women seized by police after tip-offs and forced into late-term abortions, the indignity of “menstrual monitors” and the status of “illegal” children denied ration coupons and schooling.

THE RUINATION OF RUSSIA

Russia is running out of money. President Vladimir Putin is taking a strategic gamble, depleting the Kremlin's last reserve funds to cover the budget and to pay for an escalating war in Syria at the same time.

The three big rating agencies have all issued alerts over recent days, warning that the country's public finances are deteriorating fast and furiously. Alexei Kudrin, the former finance minister, says the Kremlin has no means of raising large loans to ride out the oil bust. The pool of internal savings is pitifully small.

Vladislav Inozemtsev, from the Center for Post-Industrial Studies in Moscow, says Russia is entering a period of pauperized decline. Russia’s GDP, once at $2.3 trillion, is now at $1.2 trillion, the size of Mexico’s and smaller than that of Texas ($1.4 trillion), and continues to rapidly shrink.

Yet Russia is pressing ahead with massive rearmament, pushing defense spending towards 5% of GDP and risking the sort of military overstretch that bankrupted the Soviet Union. Bankruptcy and ruination are clearly on Russia’s horizon under Putin.

PUTIN THINKS OBAMA HAS MUSH FOR BRAINS

Russian leader Vladimir Putin has issued a caustic defense of his country's bombing raids in Syria, accusing the West of stonewalling requests for help on terrorist targets and failing to grasp the basic facts on the ground.

"We asked them to give us the information on the targets that they believe to be 100 percent terrorists and they refused to do that," he said.

"We then asked to please tell us which targets are not terrorists, and there was no answer, so what are we supposed to do. I am not making this up," he told a VTB Capital forum of bankers and investors in Moscow yesterday (10/13).

"I think some of our partners simply have mush for brains. They do not have a clear understanding of what is really happening in the country and what goals they are seeking to achieve," he said. Clearly understood by everyone was that by “our partners,” he was referring to Barack Obama.

By the end of the conference however…

WHAT DOES BILL SAY TO HILLARY AFTER SEX?

“MADE IN GERMANY” LIES IN THE GUTTER

Volkswagen has suffered a shocking loss of credibility after conspiring to violate US pollution laws and dupe customers on a systemic scale.

The scandal has once again exposed a culture of corrupt practices at the top of German export industry.

It is of an entirely different character from earlier breaches of US law by Hyundai and Ford, which stemmed mostly from errors. The US Justice Department is weighing serious criminal charges.

“It is profoundly serious. The accusation is that VW deliberately set out to mislead regulators with a cleverly hidden piece of software,” said Max Warburton from AllianceBernstein.

The financial daily Handelsblatt called the deception a “catastrophe for the whole of German industry.” It is and here’s why.

THE SYRIA CRISIS IS NOT A TEMPORARY PHENOMENON

The flood of refugees into Europe from the Middle East and Africa has only just begun as states disintegrate in a maelstrom of religious war, the United Nations has warned.

"We cannot comfort ourselves that this is a temporary phenomenon," said Peter Sutherland, the UN's special envoy for migrants and refugees.

Quite apart from Syria, much of the Sahel across sub-Saharan Africa is hanging by a thread, and ISIS is expanding into every country of the Maghreb.

Here's the EU migrant crisis explained in a 90 second video ...

ONLY HELICOPTER MONEY CAN SAVE CHINA’S CRUMBLING ECONOMY

China has bungled its attempt to slow the economy gently and is sliding into “imminent recession”, threatening to take the world with it over coming months, Citigroup has warned.

China has bungled its attempt to slow the economy gently and is sliding into “imminent recession”, threatening to take the world with it over coming months, Citigroup has warned.

Willem Buiter, the bank’s chief economist, said the country needs a major blast of fiscal spending financed by outright "helicopter" money from the bank to avert a deepening crisis.

Speaking on a panel at the Council of Foreign Relations in New York, Mr Buiter said the dollar will ...

DOES CHINA HAVE ENOUGH MONEY TO SAVE ITSELF?

China has injected $100bn of liquidity into the country’s financial system and cut interest rates to records lows in a "shock-and-awe" bid to restore confidence, but worries persist that even this may not be enough to avert a crunch as capital flight surges.

The move came as the authorities abandoned their futile efforts to shore up the stock market, allowing the Shanghai Composite index of equities to plummet by a further 7.6% yesterday (8/25). It has tumbled by 22% in the past four trading days.

The central bank (PBOC) cut the reserve requirement ratio (RRR) for lenders by 50 basis points to 18%, freeing up roughly $100bn of fresh funds. It also cut the one-year lending rate by 25 points to 4.6%. It may not be enough to add any net stimulus to the economy.

The PBOC has intervened heavily on the exchange markets to defend the yuan, drawing down reserves at a blistering pace. The unwanted side-effect is to tighten monetary policy. It is a textbook case of why it can be so difficult for a country to deploy foreign reserves – however large on paper - in a recessionary downturn.

The great unknown is exactly how much money has been leaving the country since the PBOC stunned markets by ditching its dollar exchange peg on August 11, and in doing so set off a global crash.

US FRACKERS HAVE SCREWED THE SAUDIS

If the oil futures market is correct, Saudi Arabia will start running into trouble within two years. It will be in existential crisis by the end of the decade.

The Saudis took a huge gamble last November when they stopped supporting prices and opted instead to flood the market and drive out rivals, boosting their own output to 10.6m barrels a day (b/d) into the teeth of the downturn.

Bank of America says OPEC is now "effectively dissolved". The cartel might as well shut down its offices in Vienna to save money.

If the aim was to choke the US shale industry, the Saudis have misjudged badly, just as they misjudged the growing shale threat at every stage for eight years. This link, by the way, is a delightful read, headlining US oil producers telling OPEC, “Anything you can do we can do better.”

OPEC now faces a permanent headwind. Each rise in price will be capped by a surge in US output. Saudi Arabia is effectively beached.

THE PUERTO RICO DEATH SPIRAL

Puerto Rico has triggered the biggest municipal default in US history, risking years of bitter legal warfare with creditors and an austerity "death spiral" with echoes of Greece.

The island Commonwealth finally ran out of money yesterday (8/03) after a desperate effort to stay afloat, and missed a final deadline for a $58 million payment - handing over just $628,000.

It implies a sweeping default on much of its $72 billion debt burden, equal to 100% of Puerto Rico’s gross national product (GNP) and more than five times the debt ratio of California or Texas.

Puerto Rico clearly allowed a debt crisis to creep up during the boom years, when the underlying rot was hidden from view and creditors lent without a second thought, banking on an implicit guarantee from the US sovereign state that did not in fact exist.

Clearly there’s blame on both sides with neither taking responsibility. What can be done?

RUSSIA – THE COUNTRY WITHOUT A FUTURE

Russia has fallen into full-blown depression and faces a mounting fiscal crisis as oil and gas revenues plummet.

Output from country’s state-owned gas giant Gazprom has collapsed by 19% over the past year as demand shrivels in Europe, falling to levels not seen since the creation of the company at the end of the Cold War.

Gazprom alone generates a tenth of Russian GDP and a fifth of all budget revenues. It will be several years at best before the country benefits from a new pipeline deal with China.

Russia is already in dire straits right now. The economy has contracted by 4.9% over the past year and the downturn is certain to drag on as oil prices crumble after a tentative rally. Half of Russia’s tax income comes from oil and gas.

Core inflation is running at 16.7% and real incomes have fallen by 8.4% over the past year, a far deeper cut to living standards than occurred following the Lehman crisis. This time there is no recovery in sight as Western sanctions remain in place and US shale production limits any rebound in global oil prices.

Join the forum discussion on this post

Join the forum discussion on this post